First Aid/CPR/AED with Emergency Care & Safety Institute Certification

January 6, 2025 @ 12:00 pm - 4:30 pm

$115.00 – $145.00Register Early! Class size is limited to 20 participants.

Nittany Valley Office

898 N Eagle Valley Road

Howard, PA 16841

Seminar Overview:

Learn the lifesaving skills to protect your family, friends, and co-workers! This class will incorporate hands-on training.

Certifications are valid for two years.

Instructor: Carley Smith, Owner, Carley Smith Safety Services

Carley is a graduate of Millersville University with a B.S. in Occupational Safety and Hygiene Management bringing over 20 years of safety, industrial hygiene, workers compensation and fleet safety experience to the firm.

As an Authorized OSHA Outreach Trainer, she specializes in on-site OSHA compliant safety training, as well as compliance consultation and program development. Years of manufacturing and construction site safety inspections have shaped her proactive approach to incident and injury reduction, ultimately creating a safer work environment for your team. She believes improving safety culture through employee involvement on all levels is paramount to creating a mindful approach.

Carley is NCCCO trained, a Pennsylvania Certified Accident and Illness Prevention Provider, ECSI Certified CPR/1st Aid/AED Trainer, as well as an authorized OSHA Outreach Trainer. Carley also holds the Certified Environmental and Safety Compliance Officer designation through the National Registry of Environmental Professionals.

Registration Details:

If you must cancel for any reason, please get in touch with us immediately. Cancellations received less than seven days after class start cannot be refunded; substitutions are permitted.

Registration deadline: Seven days before the session date

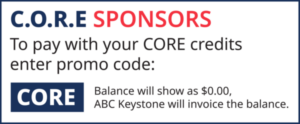

ABC Members may select the option to be invoiced. Non-members will need to pay at the time of registration either via credit card payment online or by calling the Chapter office: (717) 653-8106.

Note: STEP pricing discount available to current STEP members. STEP application must be submitted and approved before receiving discounted pricing.

EIN: 23-1618254 – Contributions or gifts are not deductible as charitable contributions for federal income tax purposes. However, members may deduct payments as an ordinary, necessary business expense. See your accountant for details.