- This event has passed.

Inaugural Gala & Annual Meeting 2025 | Presented by Benchmark Construction Co., Inc.

January 10, 2025 @ 6:30 pm - 9:00 pm

$95.00 – $3,000.00Presented by:

Lancaster Marriot at Penn Square

25 S. Queen Street

Lancaster, PA 17603

For hotel reservations, please visit the Lancaster Marriot at Penn Square website.

6:30 p.m.: Cocktail Reception

7:15 p.m.: Dinner & Program

Join us for an evening of celebration, beginning with a networking mixer, followed by a four-course dinner, program, and the annual meeting. The event will also feature the induction of the 2025 Board of Directors. Don’t miss this special occasion to honor Guy Kingree III, Benchmark Construction, 2025 ABC Keystone Chair of the Board.

Dinner Menu:

- Winter salad Iceberg (Lettuce, Crispy Prosciutto, Blue Cheese Crumbles, Tomatoes & Blue Cheese Dressing)

- Center cut sirloin with red wine Demi and Maryland crab cake with a butter sauce

- Grilled asparagus with sesame oil

- Risotto and chocolate cake

*Dietary restriction, please let us know ASAP contact Emily Winslow at emily@abckeystone.org

Suggested Attire: Black Tie Optional

Sponsorship Opportunities:

Presenting Sponsor:

Dinner Sponsor:

![]()

Cocktail Hour Sponsor $2,500

- Company hyperlinked logo on all pre and post event marketing

- Company logo on drink tickets

- Company logo on bar during networking

- Company logo on PowerPoint during dinner

- Recognition from podium during program

- Company name on signs during networking reception

- Company logo in printed program

A/V Sponsor – $2,500

- Company hyperlinked logo on all pre and post event marketing

- Company logo on bar during networking

- Company logo on table number cards

- Company logo on PowerPoint during dinner

- Recognition from podium during program

- Company name on signs during networking reception

- Company logo in printed program

Diamond Sponsor $1,000

- Company logo on table cards at dinner

- Company logo on bar during networking

- Company logo on PowerPoint during dinner

- Recognition from podium during program

- Company name on signs during networking reception

- Company logo in printed program

Sapphire Sponsor $675

- Company logo on PowerPoint during dinner

- Recognition from podium during program

- Company logo on table cards at dinner

- Company name on signs during networking reception

- Company logo in printed program

Premier Sponsor $500

- Company logo in printed program

- Company name on PowerPoint during dinner

- Recognition from podium during program

- Company logo on table cards at dinner

- Company name on signs during networking reception

- Company logo in printed program

Platinum Sponsor $325

- Company names on table cards at dinner

- Company name on signs during networking reception

- Company name in printed program

- Company name on PowerPoint during dinner

Supporting Sponsor $300

- Company name on signs during networking reception

- Company name in printed program

- Company name on PowerPoint during dinner

Registration Date: Seven days prior to the session date

Cancellation Policy: If you must cancel for any reason, please contact us immediately.

- Cancellations received less than 7 days before the start of the class cannot be refunded; substitutions are permitted.

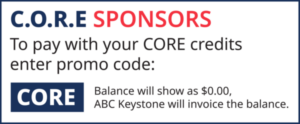

Payment Options:

- ABC Members: Select the option to be invoiced.

- Non-members:

Please pay at the time of registration either via credit card payment online or by calling the Chapter office: (717) 653-8106.

Important Note: EIN: 23-1618254 – Contributions or gifts are not deductible as charitable contributions for federal income tax purposes. However, payments may be deductible by members as an ordinary, necessary business expense. See your accountant for details.