- This event has passed.

OSHA 30-Hour Construction

January 29, 2025 @ 7:30 am - 4:30 pm

$495.00 – $690.00Manheim Office

135 Shellyland Road

Manheim, PA 17545

Session Dates

January 29 & 30, 2025 | 7:30 am – 4:30 pm (each day)

February 3 & 6, 2025 | 7:30 am – 4:30 pm (each day)

Description:

The OSHA-30 course is the gold standard for training individuals in safety supervision roles. It equips attendees with the comprehensive safety knowledge needed to effectively fulfill the responsibilities of a competent person or safety manager.

Our course will integrate the moral, business, and legal aspects of safety with detailed OSHA construction compliance education. You’ll learn about the roles and duties of a competent person, with a focus on identifying and controlling the hazards that cause 90% of jobsite fatalities—such as falls, electrical incidents, being struck by objects, and being caught in or between hazards. Additionally, we’ll cover the top 30 most frequently cited OSHA violations, which contribute to 90% of construction fines.

Lunch and snacks included.

Instructor:

Craig Shaffer is a Certified Safety Professional who has spent the past +30 years in applied safety management, training, and OSHA compliance consulting, with emphasis in the construction industry. Half of his time is spent training and the other half functioning as a safety director for contractors in the region.

Craig is an authorized construction OSHA-10 & -30 instructor and a certified Red Cross 1st aid/CPR/AED instructor. He has served on and chaired both local and national ABC safety committees and has spoken at over 15 state and national conferences, covering a variety of construction safety-related topics.

Registration Details:

Preferred Registration Deadline: Seven days before the session date

If you must cancel for any reason, please get in touch with us immediately. Cancellations received less than 7 days before the start of class cannot be refunded; substitutions are permitted.

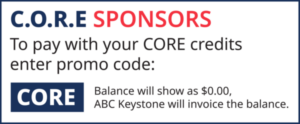

ABC Members may select the option to be invoiced. Non-members will need to pay at the time of registration either via credit card payment online or by calling the Chapter office: (717) 653-8106.

EIN: 23-1618254 – Contributions or gifts are not deductible as charitable contributions for federal income tax purposes. However, members may deduct payments as an ordinary, necessary business expense. See your accountant for details.

EIN: 23-1618254 – Contributions or gifts are not deductible as charitable contributions for federal income tax purposes. However, payments may be deductible by members as an ordinary, necessary business expense. See your accountant for details.