Arc Flash & Energized Electrical Work Safety

March 9 @ 7:30 am - 3:30 pm

$165.00 – $235.00Manheim Office

135 Shellyland Road

Manheim, PA 17545

Due to mandated safety training limitations on class size, if you are registering more than 10 people, please contact our office directly for assistance by calling

717-653-8106 or emailing leslie@abckeystone.org.

NOTICE:

All participants are required to wear hard-sole work boots, long pants (such as work pants (Dickies®, Carhartt® etc.) or jeans – no sweatpants or leggings are permitted) and sleeved shirts (short or long sleeves). Participants must bring a hard hat and safety glasses for use when in the training area. Non-compliance with these requirements may result in being denied entry into the training and no refund will be issued.

Description:

Work on or near energized electrical components presents lethal risk. The horrific injuries from electrical shock & arc flash burn injury can become reality in the blink of an eye. Although restricted, live electrical work is sometimes necessary and if you work on or around energized electrical conductors there is A LOT you need to know. Come learn the NFPA 70E protocols, equipment, PPE, & planning needed to avoid catastrophe. You can’t afford not to learn this!

Who Should Attend?

Electricians, maintenance staff, HVAC techs, safety managers, and site supervisors.

Instructor:

Craig Shaffer is a Certified Safety Professional who has spent the past +30 years in applied safety management, training, and OSHA compliance consulting, with emphasis in the construction industry. Half of his time is spent training and the other half functioning as a safety director for contractors in the region.

Craig is an authorized construction OSHA-10 & -30 instructor and a certified Red Cross 1st aid/CPR/AED instructor. He has served on and chaired both local and national ABC safety committees and has spoken at over 15 state and national conferences, covering a variety of construction safety-related topics.

Registration Date: Seven days prior to the session date

Cancellation Policy: If you must cancel for any reason, please contact us immediately.

- Cancellations received less than 7 days before the start of the class cannot be refunded; substitutions are permitted.

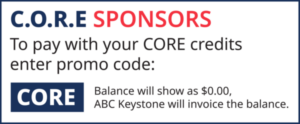

Payment Options:

- ABC Members: Select the option to be invoiced.

- Non-members:

Please pay at the time of registration either via credit card payment online or by calling the Chapter office: (717) 653-8106.

Important Note: EIN: 23-1618254 – Contributions or gifts are not deductible as charitable contributions for federal income tax purposes. However, payments may be deductible by members as an ordinary, necessary business expense. See your accountant for details.