- This event has passed.

Executive Leader Contractor Peer Group

February 19, 2025 @ 7:30 am - 10:00 am

$199.00 – $699.00Manheim Office

135 Shellyland Road

Manheim, PA 17545

Description:

ABC’s Executive Leader Peer Group has proven to be an invaluable resource for CEOs and top-level decision-makers representing companies of diverse size and industry. The first half of the workshop consists of an introduction and instruction on the subject of the day, and the second half focuses on real world application. This could include case studies, attendee trouble shooting, best practice sharing, and peer coaching.

- Gain close relationships with industry peers.

- Discuss common challenges and brainstorm solutions.

- Learn best practices from other industry leaders.

- Explore new methods with others facing similar challenges.

Four Session Series – Join Any Time at Series Rate

Session Dates:

February 19, 2025 | 7:30 am – 10:00 am

April 17, 2025 | 7:30 am – 10:00 am

July 17, 2025 | 7:30 am – 10:00 am

October 9, 2025 | 7:30 am – 10:00 am

Facilitator:

Witmer, of Pathway Business Advisors, founded and grew a leading nationwide business that achieved over $16 million in sales and employed 62 people, all while becoming profitable within just 8 months of launch. He is currently an owner and partner at Pathway Business Advisors. Jeff is a seasoned expert in numerous areas of business management and systems, including team development, sales and marketing, finance and accounting, and information technology.

Registration date: Seven days prior to session date.

Price includes: Instruction and Interactive Role-Play Activities

If you must cancel for any reason, please contact us immediately.

Cancellations received less than 7 days of the start of class cannot be refunded; substitutions are permitted.

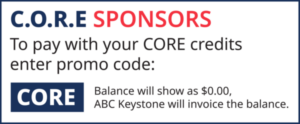

ABC Members may select the option to be invoiced.

Non-members will need to please pay at time of registration either via credit card payment online or by calling the Chapter office: (717) 653-8106.

EIN: 23-1618254 – Contributions or gifts are not deductible as charitable contributions for federal income tax purposes. However, payments may be deductible by members as an ordinary, necessary business expense. See your accountant for details.