- This event has passed.

ABC Bluebeam® Courses: Bluebeam Revu for Administrative Professionals – Virtual Event

April 16 @ 2:00 pm - 4:00 pm

$110.00 – $165.00ABC Bluebeam® Courses: Bluebeam Revu for Administrative Professionals

Tuesday, April 16, 2024 | 2:00 p.m. – 4:00 p.m. (Live, Online Class)

For more information, view a recently recorded launch webinar here: https://youtu.be/iv9I4mwbijk

Gain Proficiency with Bluebeam Revu’s Interface Navigation

Webinar Overview:

Administrative teams have unique document workflows that demand a different set of tools compared to design and construction teams. A typical Bluebeam class concentrates on design markups, estimating and collecting field data, but this class is very different! In just two hours you’ll be ready to combine documents, mark for redaction, apply digital signatures and several other important administrative tasks.

Learning Objectives:

- Extracting pages from existing documents

- Use Redaction to quickly clean sensitive information from documents

- Creating and applying digital signatures

- Updating Page Labels

- Applying headers and footers

- Search document text and visual symbols

- Apply stamps

- Flag important content in documents

Course Requirements (Technology & Participation):

Please ensure you meet the following requirements:

- Have Bluebeam 2018 or newer installed, and ready to go before class. If you don’t currently have a license of Bluebeam Revu, you can download a free trial here.

- Attendance via tablet or phone is not recommended. You should have a mouse with a scroll wheel when attending this class. In Bluebeam there are several right-click shortcuts, and the wheel will help you zoom in/out on documents.

- 2-screen computer set-up is recommended. This will allow you to watch the instructor on one screen while practicing on the other.

Instructor:

Instructor:

Troy DeGroot, Bluebeam Certified Instructor, UChapter2 | Owner As a Bluebeam Certified Consultant, Bluebeam Certified Instructor, and Implementation Specialist, Troy travels the country training over 2,000 students annually with customized tools and workflows. It is these extensive and diverse training opportunities that have led to Troy being a requested annual presenter at AIA meetings, Bluebeam Academy and Bluebeam’s very own eXtreme Conference (XCON).

With over 20 years in the industry, Troy has cultivated a deep understanding of the requirements of customers, the needs of end users, common goals of management, and the capacities of the technology. He has led many companies through successful software implementations and training. Having served as the BIM Manager for a large multi-discipline engineering firm, he provides a broad understanding of the industry and the evolution of technology.

Who Should Attend:

This course will benefit all those who would like to increase their abilities with Bluebeam.

Registration Details:

Preferred registration date: 7 days prior to session date

Price includes: Hands-on instruction

Cancellations will be accepted up to 7 days prior to session date. Substitutions can be made at any time. If you do not cancel, reschedule, or substitute prior to class you are responsible for full payment.

ABC Members may select the option to be invoiced. Non-members will need to please pay at time of registration either via credit card payment online or by calling the Chapter office: (717) 653-8106.

EIN: 23-1618254 – Contributions or gifts are not deductible as charitable contributions for federal income tax purposes. However, payments may be deductible by members as an ordinary, necessary business expense. See your accountant for details.

ABC Keystone Membership can help you advance your business!

Contact Mike Bachman Director of Membership to find out more.

Details

- Date:

- April 16

- Time:

-

2:00 pm - 4:00 pm

- Cost:

- $110.00 – $165.00

- Event Categories:

- Blueprint Reading, Business Development, Career Development, Professional Development, Technology

- Event Tags:

- bluebeam, Microsoft, MS Word

- Website:

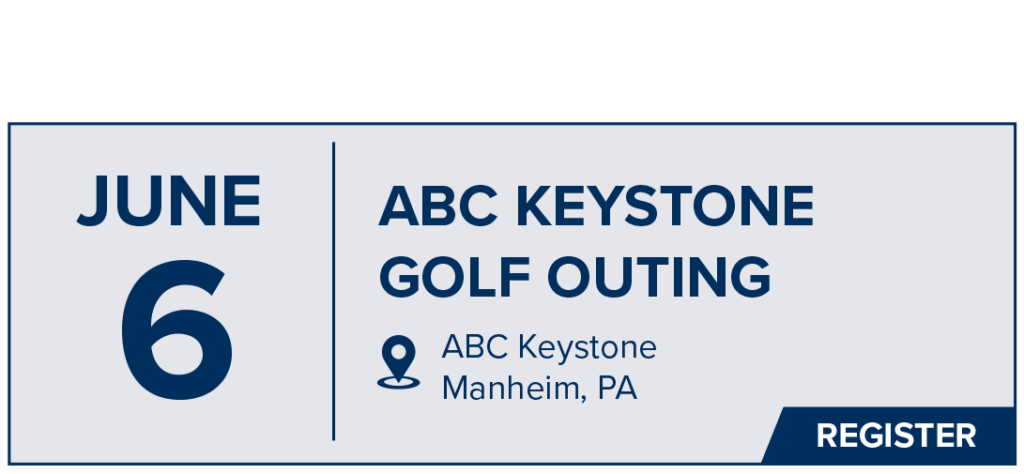

- www.abckeystone.org

Organizers

Venue

- ABC Keystone

-

135 Shellyland Road

Manheim, PA 17545 United States + Google Map - Phone

- 717-653-8106

- View Venue Website